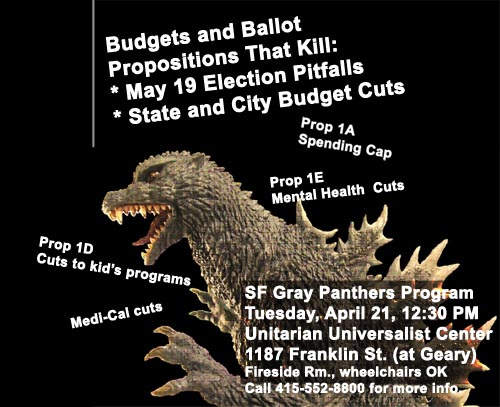

Budgets and Ballot Propositions that Kill

California’s recent budget agreement is a disaster for seniors, kids, people with disabilities, and low-income working families, with devastating cuts to schools, medical care, income support, home care, and many other vital services. The Budget also includes $690 million in tax cuts for big business.

And now the State’s Department of Finance and Treasurer misrepresent California’s share of the federal stimulus bill in order to justify even further cuts in medical care and income assistance to our poorest seniors, people with disabilities, and working families. (See below.)

But as bad and as oppressive as this state budget is, it depends on passing six May 19 Special Election Propositions, some which are even worse than the budget itself. They must be rejected for our survival but union opposition is fragmented and the responsibility for grass-roots organizing is greater.

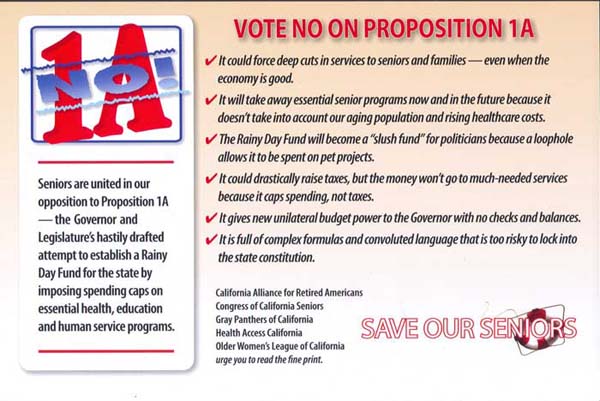

Prop 1A, A Permanent Spending Cap

This “hard” state Spending Cap would make the severe cuts of the last few years permanent, including $15 billion this year, and $19 billion in the past 3 years. State spending could only increase in step with the Consumer Price Index (which is much lower than the rate of inflation for health care and social services in a depressed economy) or with increased population (which ignores other changes like increased poverty or near-doubling of the over-65 population.) Regardless of future needs, the Spending Cap could be lifted only by a 2/3 vote in a state-wide election. Ironically, Prop 1A itself only needs a majority vote to pass. In return for permanently limiting future spending, Prop 1A extends this year’s temporary increases in sales, income, and vehicle taxes from two to four years.

The complex language of Prop 1A creates a Constitutional amendment limiting the amount of revenue that can be appropriated to the General Fund, which finances education, health care, and most other core services. Remaining revenue is diverted into a Budget Stabilization Fund, dedicated to deficit reduction, or highly restricted rainy-day relief (or to education if companion Prop 1B passes).

If the economy recovers, future increases in State revenue above today’s depressed levels would be considered “unanticipated revenue” and be diverted to the Budget Stabilization Fund, effectively freezing state spending at today’s values.

The California Budget Project has calculated that if Prop 1A had been implemented in 1995, using that year’s budget as base, there would have been about $40 billion less dollars last year to pay for all state spending. In addition to freezing future state spending, Prop 1A gives the Governor the ability to cut certain spending like CalWORKs and SSI/SSP Cost-Of -Living-Allowances midyear without legislative approval.

Come and hear Colleen Rivecca, of the Coalition to Save Public Health, and Hene Kelly, of the California Alliance for Retired Americans (CARA), talk about how we can explain these threats to others and organize to overcome them.

Read "Crisis in SF Budget and Services," an article from the April 2009 SF Gray Panthers Newsletter (pdf, page 4).

Read the California Budget Project's Overview "Uncharted Waters: Navigating the Social and Economic Context of California's Budget" (PDF)

Read the California Budget Project's new analysis of Proposition 1A, the Spending Cap.

Read the California Alliance for Retired Americans (CARA) alert on the State's underestimation of federal stimulus money in order to eliminate adult dental care, vision care, hearing tests, mental health care, and cut public hospital assistance from Medi-Cal, cut SSI checks $20 per month, cut aid to low-income families with children $30 per month, and reduce wages of In Home Supportive Services workers to minimum wage. |